Your home is usually the first thing that comes to your mind when you think about real estate investing. Naturally, when it comes to selecting investments, real estate investors have many alternatives that don't just involve physical real estate.

Real estate has gained popularity over the last fifty years as an investment instrument. Here are some of the best options available to individual investors, along with a few strong reasons for investing in an investment.

Essential Notes

1. At the very least, real estate needs to be included in a portfolio with sufficient variety since it is regarded as a unique asset class.

2. Buying and holding rental properties is one of the main ways that real estate investors can profit.

3. Flippers try to purchase properties at a discount, make repairs, and resell them for a profit.

4. REITs, or real estate investment trusts, offer indirect real estate investment without requiring the ownership, management, or financing of real estate.

Historical Prices

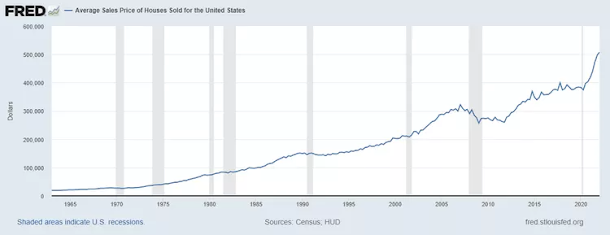

It makes sense that real estate has long been seen as a wise investment. Housing data from the past created the impression that prices might rise indefinitely before 2007. Almost all years from 1963 to 2007, when the Great Recession started, saw an increase in the average price of homes sold in the United States.

At the start of the COVID-19 pandemic in the spring of 2020, home prices did experience a little drop. Still, house values shot up, hitting record highs by 2022 as vaccinations became more widely available and concerns about the pandemic disappeared.

This graph, which displays average sales prices from 1963 to Q1 2022 (the most recent data available), is from the Federal Reserve Bank of St. Louis. A recession in the United States is indicated by the areas that are light gray colored.

Rental Properties

It's important to think about whether you'll feel comfortable in the job of a landlord if you decide to invest in rental homes. It will be your duty as the landlord to take care of the property, locate renters, maintain it, and handle any issues that arise. Other responsibilities will include paying the mortgage, property taxes, and insurance.

Being a landlord requires work except you have a property manager who takes care of the technical issues. Looking after the property and the residents may require a full-time, often difficult, job, depending on your circumstances.

However, you can reduce the possibility if you properly select your homes and renters the risk of having major problems. Landlords receive income from collecting rent.

The rental's location will determine the maximum amount you can charge for it. However, figuring out the ideal rent can be challenging because charging too little will result in money being left on the table, and charging too much would drive away residents.

Renting out space long enough to pay for overhead is a popular strategy; after the mortgage is paid, most of the rent is turned into profit. Renters also profit mostly from appreciation in other ways.

As time goes on, you might be able to sell your house for a profit or take out a loan against the equity to fund your next project if its value increases. There are no promises, given that real estate continues to appreciate.

This is particularly true when there is a significant change in the market for real estate, as there has been most recently during the COVID-19 pandemic. The average cost of real estate in the United States increased by an incredible 48.5% between February 2020 and March 2024.

Flipping Houses

Real estate flippers are a whole different breed from buy-and-rent landlords, just like day traders are from buy-and-hold investors. Flippers purchase real estate to own it for a little time—typically three to four months—and then sell it swiftly to make a profit.

There are two main methods for selling a house quickly:

1. Fix and modernize. Using this strategy, you purchase a home that you believe will appreciate specific renovations and repairs. Ideally, you finish the job as soon as feasible and sell for more money than you initially invested (including the renovations).

2. Resell and hold onto. This kind of flipping operates uniquely. Instead of investing in and renovating real estate. You invest in a market that is expanding quickly, hold it for a few months, and then sell it for a profit.

You carry the risk that you won't be able to sell the property for enough money to make a profit with any kind of selling. Because flippers typically don't have enough cash on hand to cover long-term mortgage payments on houses, this might be difficult. However, if done correctly, flipping real estate may be a profitable method to invest.

REIT’s

A corporation (or trust) established to employ investor funds for the collection, management, and sale of properties that generate income is known as a real estate investment trust (REIT). Like stocks and exchange-traded funds (ETFs), REITs are purchased and sold on major exchanges.

The company must distribute 90% of its taxable income to shareholders as dividends to be recognized as a REIT. In comparison to a typical business, which would have to pay taxes on its profits, reducing the amount of returns it could give to shareholders, REITs can avoid paying corporate income tax by doing this.

Although they also provide the chance for appreciation, REITs are suitable for investors who seek consistent income, much like equities that pay dividends regularly.

Real estate investment trusts (REITs) engage in a diverse range of properties, including office buildings, hotels, mortgages, and malls (approximately 25% of all REITs focus on these types of properties). A highly liquid asset class, REITs offer a distinct advantage over other real estate investing options.

Real Estate Investment Groups

REIGs, or real estate investment groups, look similar to small mutual funds specifically designed for rental properties. A real estate investment group can be your best option if you'd like to own a rental property but don't want the headaches of landlords.

A corporation will construct or purchase a group of structures, usually apartments, and then permit investors to purchase them via the company, which makes them a member of the group. One or more independent living units may be owned by a single investor.

However, the business running the investment group supervises each unit and handles all maintenance, marketing, and renter placement. The business receives a portion of the monthly rent in return for this management.

Investment groups come in several forms. For protection against irregular vacancies, the normal type of the lease is in the name of the investor and each unit pools a portion of the rent.

Real Estate Limited Partnerships

A real estate limited partnership (RELP) and a real estate investment group are similar. This firm was founded to buy and manage a group of properties, or sometimes just one. However, the existence of RELPs is short.

An experienced real estate development firm or property management makes up the general partner. The real estate project will then look to outside investors for funding in return for a limited partner's ownership stake.

Real Estate Mutual Funds

The primary investments made by real estate mutual funds are in REITs and real estate operating companies. With relatively little capital, they offer the chance to obtain broad real estate risk. They allow investors a far wider range of assets to choose from, depending on their strategy and diversification objectives than can be achieved through buying individual REITs.

These funds, like REITs, are quite liquid. The fund offers research and analytical data, which is a major benefit for regular investors. This can include information about recently purchased assets as well as management's evaluation of the performance and viability of particular real estate investments taken as an asset class.

Why Invest in Real Estate?

Since real estate offers competitive risk-adjusted returns, it can improve the risk-and-return profile of an investor's portfolio. Particularly when contrasted with bonds and stocks, the real estate market is typically less volatile.

When compared to more traditional methods of income return, real estate is also appealing. In an environment where Treasury rates are low, this asset class is particularly attractive. It normally trades at a yield premium compared to US Treasury bonds.

Inflation Hedging

The relationship between GDP growth and demand for real estate is positive, which accounts for real estate's potential to hedge against inflation. Rents rise in response to an expansion of economies because of the demand for real estate, which raises capital values.

The Power of Leverage

One instrument that investors in the stock market do not have access to, except REITs, is leverage. By using debt to finance a larger purchase than you have available cash for, you are leveraging your financial situation.

Unless you are purchasing on margin, the entire purchase price of the stock must be paid at the moment the buy order is placed. The proportion you can borrow is still far lower than with real estate.

Conclusion

Real estate can generate wealth and consistent revenue, making it a wise investment. Liquidity, or the more difficult process of turning an asset into cash and cash back into an asset, is still a disadvantage of real estate investing.

Closing on a real estate deal might take months, in contrast to the few seconds it takes for a stock or bond transaction. Finding a suitable partner might take weeks of labor, even with a broker's support.

0 Comments